Artificial Intelligence has become the hottest buzzword of our era. From billion-dollar GPU orders to AI startups raising funding with no revenue —it feels like the dot-com bubble.

So what is the AI Bubble ? Is it actually a bubble or a fake news getting some traction ?

Yes — And No.

AI Is Real — the Hype Is Not Always

There are two layered realities:

AI technology is truly transformative

It’s already improving drug discovery, logistics, coding, energy efficiency, and more.

Valuations and promises are often unrealistic

Many AI startups are just thin wrappers on big foundational models with no path to profit.

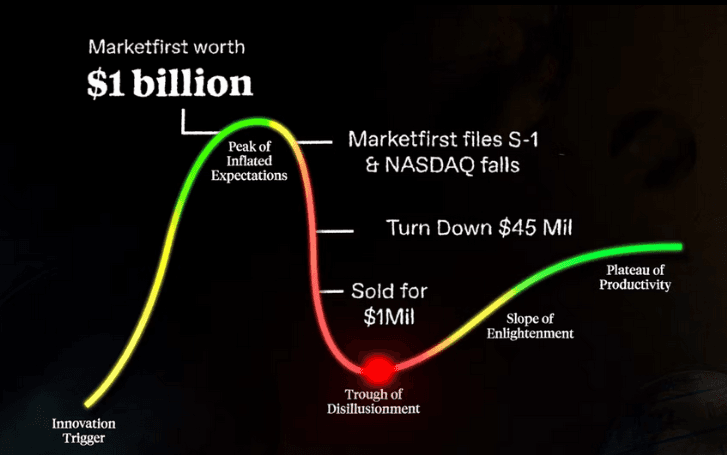

*Read about the Gartner Hype Cycle to understand this better .

Signs of the AI Bubble

| Red Flag | What It Looks Like in AI |

|---|---|

| 🚀 Exaggerated promises | Artificial General Intelligence will arrive next year! |

| 📈 Valuations > Revenue | Startups valued at billions… with no customers |

| 🎭 Buzzword-driven products | “AI-powered toothbrush for pets” |

| 🏃♂️ FOMO investing | Buying because everyone else is buying |

| 📡 CPU → GPU gold rush | Hardware scarcity, inflated costs |

But AI Will Change Everything | Why do we believe in AI Bubble burst?

Even if the bubble bursts, AI adoption will accelerate:

- Coders become 2–3× more productive

- Content automation at massive scale

- Robots and agents performing complex workflows

- Faster scientific breakthroughs

Think electricity + Telephone+ Internet level disruption.

Bubbles come and go — breakthroughs stay. Dot com was a bubble but breakthroughs happen after corrections.

How Not To Fall Into the AI Trap

Here are practical strategies to stay smart:

1️⃣ Follow Value, Not Hype or AI bubble related news

Ask:

“If the term ‘AI’ disappeared from the pitch — does the product still solve a real problem?”

Look for:

- Clear customer pain points

- Demonstrated cost savings or revenue lift

- Early adoption success stories

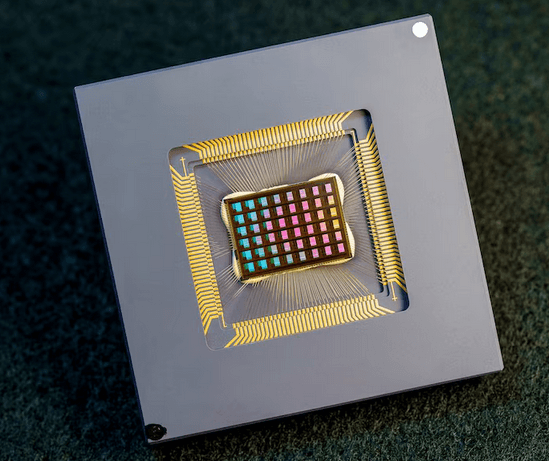

2️⃣ Back Picks & Shovels

During the gold rush, winners sold shovels.

In AI, those are:

- Cloud infrastructure (compute, storage)

- Semiconductor + GPU ecosystem

- Cybersecurity (AI creates new threats)

- Enterprise AI platforms

These tend to survive hype cycles.

3️⃣ Evaluate Moats

Good moats include:

- Unique proprietary data

- Deep technical IP

- Distribution advantage

- Workflow integration (not easily replaced)

If a startup just uses open models? → Danger zone.

4️⃣ Diversify — Don’t Bet on One Winner

History lesson:

For every Amazon or Google, hundreds of Netscapes + Lycos.

Spread your risk.

5️⃣ Focus on Skills, Not Stock Tips

The best investment is your relevance.

Top future-proof skills:

- Domain expertise + AI tools

- Data literacy

- Product & automation strategy

- Creativity + judgment + leadership

Humans who master AI will replace those who don’t.

What Happens If the AI Bubble Bursts?

Short-term:

- Startup failures

- GPU prices normalize

- Hype cools → panic headlines

Long-term:

- Productivity soars

- AI integrates into every industry

- New trillion-dollar giants emerge

A bursting bubble doesn’t kill the technology — it strengthens it.

How to Avoid the AI Investment Trap

The risk isn’t necessarily in the technology itself, but in overpaying for future potential or falling prey to hype-driven speculation. Here are ways to navigate this environment for an AI Trap :

1. Focus on Fundamentals Over Hype

- Demand Clear Paths to Profitability: Be skeptical of companies with massive spending plans (especially on infrastructure) but unclear short-term revenue generation. Look for clear business models where AI solves a concrete, costly problem.

- Look Beyond the “AI Label”: Avoid investing solely because a company has slapped an “AI” label on its products (a concept sometimes called “AI-washing”). Scrutinize how they are using it and what actual competitive advantage it provides.

- Valuation Check: Compare metrics like the Price-to-Earnings (P/E) ratio to historical averages and sector peers. Extreme deviations may signal speculative pricing.

2. Manage Portfolio Concentration

- Don’t Go All-In on a Few Names: If a significant portion of your portfolio is weighted toward the few stocks driving the AI rally (like the “Magnificent Seven” or leading chip makers), you are highly exposed to their specific performance.

- Consider Equal-Weighting: If you use index funds, explore equal-weighted index funds. These spread capital evenly across all companies in an index, automatically reducing the massive weight given to the largest, most expensive stocks.

- Re-balance Strategically: If your AI-related holdings have grown to an uncomfortable percentage of your total portfolio, consider re-balancing by trimming those winners and investing the proceeds into less expensive, more established sectors like utilities, healthcare, or value stocks.

Summary

AI is not a passing trend — it’s the new foundation of the digital world.

But the market around AI is overheated and will correct.

Who will be the winners?

People and companies who:

Recognize real value

Invest selectively

Develop skills that compound with AI